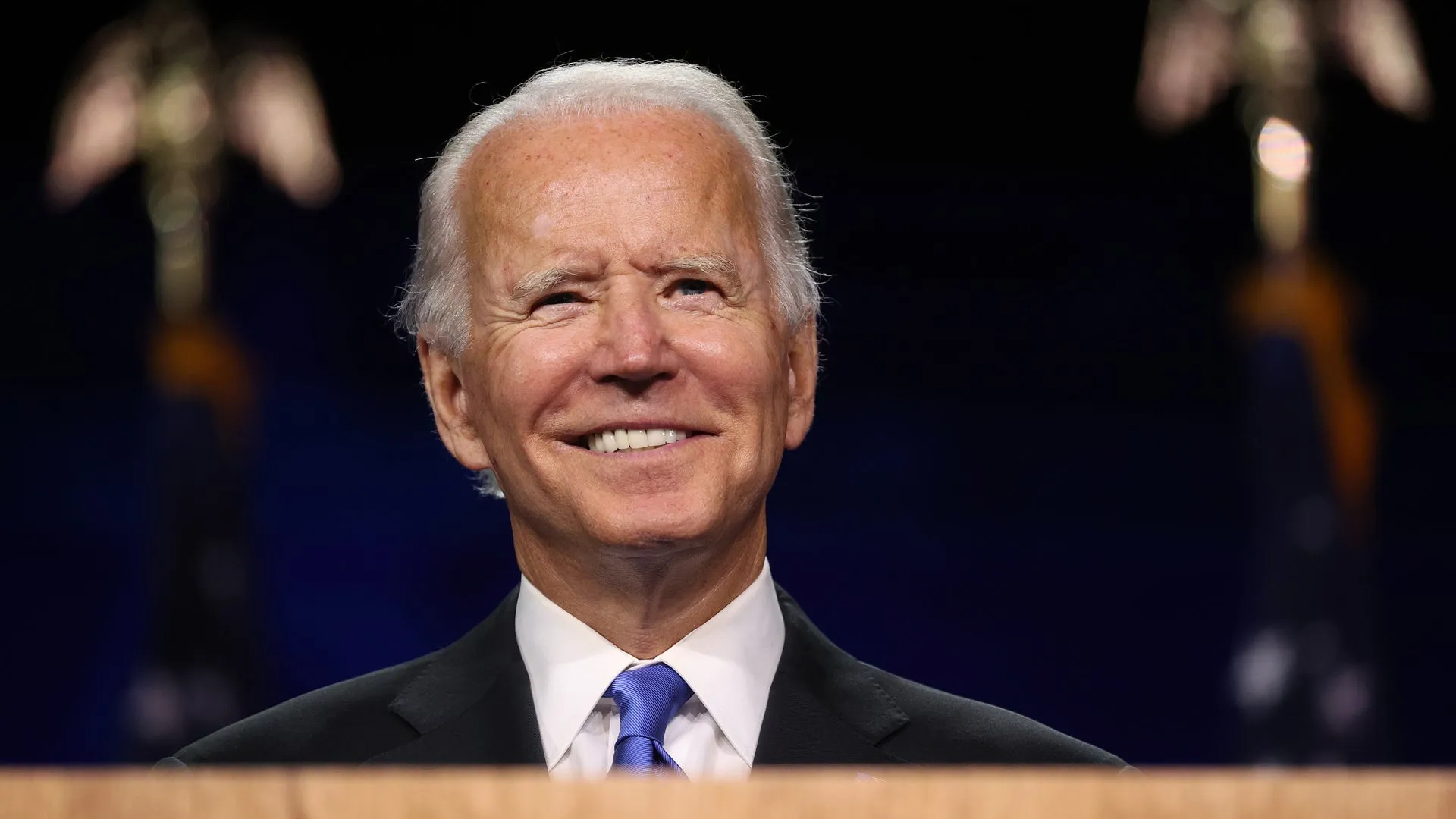

Bidens Capital Gains Tax Proposal Sparks Controversy in the US Economy. Amid India’s intense political debates on inheritance tax, the United States is grappling with its own upheaval as significant tax increases loom over the nation’s economy.

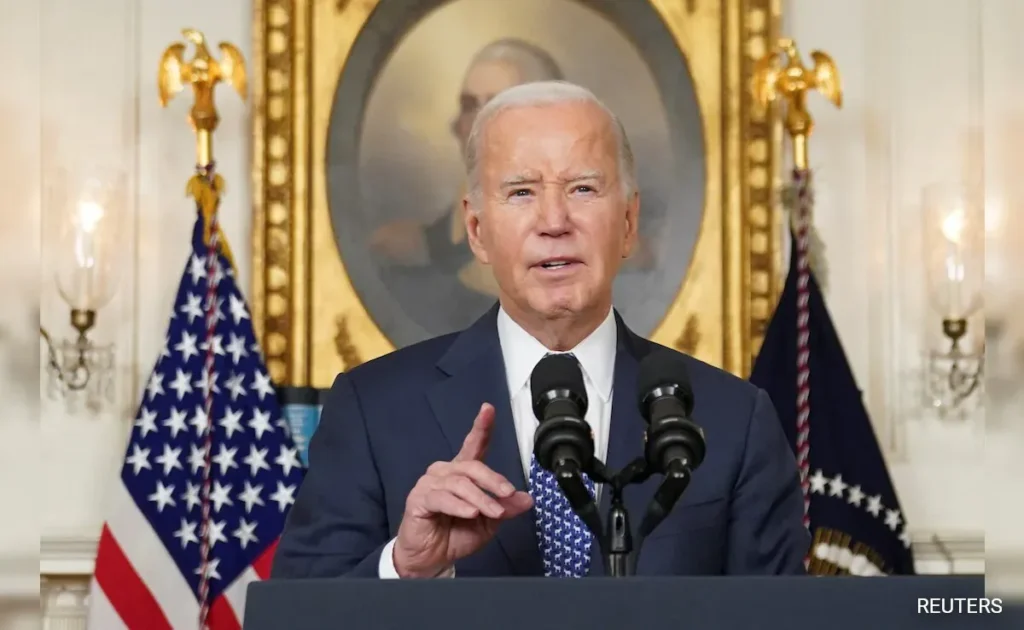

President Joe Biden’s plan to raise the capital gains tax rate in the US, outlined in the 2025 budget unveiled on March 11, has stirred considerable controversy. This proposal, set to take effect from January 1 of the following year if Biden secures re-election in November this year, has raised concerns across the country.

Biden’s plan aims to raise the capital gains tax to 44.6% for individuals with a taxable income exceeding $1 million annually and an investment income surpassing $400,000. If implemented, this would be the highest capital gains tax rate in US history, surpassing the previous high of 40% under President Jimmy Carter in the late 1970s. In comparison, India’s capital gains tax ranges from 10% for long-term investments to 32% for short-term investments.

Some states would see an even more significant increase in the capital gains tax rate, with figures exceeding 50%. California, for example, could see a rate of 59%, while New Jersey’s could exceed 55%. Oregon, Minnesota, and New York are also expected to have rates above 50%.

Supporters of Biden’s tax plan argue that it targets the wealthy and could provide a significant boost of over $5 trillion to the US economy over the next decade. However, critics offer a different perspective. According to the Tax Foundation, the proposed tax hike could lead to a 220-basis-point reduction in US GDP in the long run, along with a 160-basis-point decrease in wages and the loss of 788,000 jobs. Detractors also argue that the new regulations would significantly complicate the US tax code.

Impact of Biden’s Proposed Capital Gains Tax Rate on High-Income Earners

However, it’s important to note that the proposed rate hike is not guaranteed. The 44.6% rate would only be applicable under a separate proposal from the Biden administration’s main capital gains rate increase. Additionally, it would only apply to individuals with taxable income above $1 million and investment income above $400,000, making high earners the primary targets of the proposal.

Biden’s budget blueprint includes other tax increases as well. It aims to raise the corporate tax rate from 21% to 28%, eliminate deductions on salaries exceeding $1 million annually, impose a 25% minimum tax on individuals with assets exceeding $100 million, and eliminate exemptions on gifts and estate taxes. The estate tax, applicable upon an individual’s death, is set to rise to an effective rate of 60% to 80%.

In Conclusion- Bidens Capital Gains Tax Proposal Sparks Controversy in the US Economy

These proposals have sent shockwaves through US businesses, especially given the timing in an election year. Republicans in opposition warn that the proposed tax hikes could be disastrous for small businesses and entrepreneurs, stifling innovation and impeding growth. Some even argue that it could lead to a decrease in overall demand, affecting other sectors and potentially plunging the country into recession.

As the debate rages on, all eyes are on the upcoming elections and the potential impact on the economic landscape of the United States.

Influencer warns Gen Z is becoming Gen Terrorism as TikTok takes ominous turn after Oct 7